Design and results of algorithms for automated trading programs.

Here's my setup (there are actually two more screens on the right not shown for the Oracle database)

more info on 1 day of trading stocks1.htm

The program is running well,

it scans initially for stocks that are volatile , capable of large changes for

intraday trading, then for volume trends. It watches for large transactions and

market changes and attempts to skim the profits off the resulting trends.

The stocks are watched for

directional trends and reversals. The program

recognizes 4 patterns very well, I'm in the process of adding 5-6 more.

I describe the pattern and then feed historical data into the program and it tunes itself using the data. It builds multiple tables for each pattern and finds the best match against the stocks it's watching (TrendWatch).

It has a confidence factor 0 to

200% on the match and momentum, history, beta value, social and business news.

I have a window pop-up for each of my

TrendWatch processes when it is getting close to an action point (such as a buy

or escalation of confidence) it displays all the parameters and data it has

at the moment. They stack on top of each other with title bars displaying the

major parameters, I can open and watch

each thread graphically. (i'll post pictures of the program tomorrow.)

Thursday was first day of fully automated trading / testing

of my new program Most orders were stopped out immediately because of very tight

stop-loss settings (intentional for now, I'll loosen then as I gain confidence)

, These were the best trades:

CSTM BOT 5.67 SOLD 6.90

ITG BOT 17.78 SOLD 20.26

RLYP

BOT 17.595 ... held

Friday:

RLYP BOT 17.595 had been held overnight .. sold at Friday's opening surge for

20.40

TRIP

-bought TRIP and sold for $2 profit each share (74.03 - 76.04)

Up trend works on finding (varying) >2%-3% trends (it also looks at longer context

hi/low prices also to decide if the trend is likely to continue , also considers

volume/time, news confidence input ratings)

Currently reversals are working best ( like TRIP ).. It

appears to be the easiest pattern for the program to recognize , and it knows

about finding a bottom and waits for a green bar. after it saw a low of 73.57

and then a change red to green.. it triggered a buy

The automated programming appears to be the simple part ...

The real goal seems to me now to be stock scanning and selection to feed into the

evaluation engine ... pick the right stocks and the rest is easy. The program works best in a dynamic rapidly changing market

and it can make better decisions than most investors.

FORUM description

I'm a professional programmer, wrote and continue to write a trading application for IB TWS for myself. My original goal was to create a TWS assistant that could very quickly enter orders with a stop loss and/or profit taker. After that was working I saw how easy it would be to automate trading to different degrees (fully or semi). I am creating a video demonstrating the application. I had no intention of selling the program originally, but have some offers I am considering.

I'm calling this ATS

(Automated Trading System). (it's running on Windows 10 currently, also tested with

W7) I am the author of many programming and database books. Worked for many of

the top companies in the US.

My program currently does:

- Data input

/export (to / from files for contract, ticker info, accounting) , documents to

log files all actions.

- QuickOrder dialog - lets you set buy, sell, stop loss

parameters before they are sent, tracks current positions and is operated by the

user or automated ..

- Assign single function key actions:

-- buy , -buy

with stop loss and/or profit taker (market, limit etc.)

-- sell , sell all ,

scale out (market , limit)

-Uses templates for the setup (stop loss

offset, or trailing stop loss etc.) and single keys can adjust common parameters

(quantity, time-in-force etc.)

-Trend Watch - can watch up to 100 stocks

and can trigger actions when levels are meet. (but can scan thousands of stocks

per second and then input those of interest to the Trend Watch.

For example it can watch for a

3% (any percent) increase and then can trigger the functions described. It

displays a new window for stock (contract) at whatever level (2% for example)

and display the values , the parameters and has buttons to prevent or allow each

action... Or it can just display the QuickOrder dialog when triggered and be in

manual mode.

-Has full access to my account , positions, preferences, ..

so for example, using it as the Assistant :I'm watching a stock, I see a trend and want to enter:

I hit F4 - it buys the stock (100, 1000 or entered) at either market or limit , sets

the stop loss (say 2% or 4% less than last price ..or an offset (-$0.50) . (F5,

F6 toggle quantity and trailing stop loss and offsets to my preferences)

The action is shown in the QuickOrder window and shows up immediately in TWS

orders.

I watch the stock and have options (single key):

F2 - sell all (market or

limit)

F3 - scale out (100, 50, 25 , 33 %)

F4 - buy additional

this

is has been working for over 6 weeks, I use it and improve it everyday.

Now

I'm adding my own scanners to find the stocks I'm interested in (I do mostly day

or swing trading). I would like to show it to get ideas for the next additions

and will create screen snapshots or a video to demonstrate it.

It has

test modes, where it can connect to the simulated trading (paper) account and

can generate stock tick data (prices, volume) etc. that can be used to simulate

market conditions ... has a favorite stock list, 100's of options .. all can be

preset

It does lots more .. the scanning is proving to be the most value, it

can spot trends outside the stocks I've selected and then be added in to my

list.

I'm adding patterns that I know and use. The most basic first such as 1) trend, 2) trend with pullback and continuation or breakout 3) reversals 4) channels (up or down) 5) gappers (sudden changes of price overnight)

The patterns are graphs (outlines) then stored in tables, each table represents one pattern. The actual values are interpolated so they can be stretched or compressed by time frame . Patterns can sequence or be inserted into each other.

(I have programmed lots of waveforms previously, electronic music and sound engineering. So waveforms, graphs, slopes, interpolations and forward prediction on rate of change are familiar to me).

(in a trend) Historic data I find 70% of the time show some larger context for the current trend, and if the price had been much higher in the past, it is likely that a current trend could reach higher levels.. sometimes though a stock is breaking into a new range and redefinition so that history may not apply at all .. that's what makes fishing for a new floor dangerous, the stock may be failing .. and fall to new lows ...

Most of my previous work focused on database engines and data analysis and I had a focus in query (db) tuning ... given market data, the program finds the best pattern match that it knows (currently only 4. soon that will be 10-11 that I've sketched out) then the program makes a prediction (it usually has several alternative plans) .... then after the execution, the program considers the outcome success, views the alternatives that were rejected and then decides if one of them would have worked out better and grades itself .. in the next iteration it will have higher or lower confidence and will weight it's decision accordingly (in the case of a high success, next time confidence will be higher and maybe a little more daring in its buy (maybe earlier) and the sell (maybe will ride out more bumps rather than selling on the first decline) ...

-- confidence can also be injected from me (user) or other processes based on experience, some knowledge particular to the situation or social networks, rating upgrade or downgrade .. etc.

there are other rankings in play such as volatility (these are performance factors, separate from the patterns)

I have a huge library of C# and C++ code that I have created over the last 10+ years .. mostly reusable utility functions (file system, monitor/display management, init file data , email, messaging, debugging, logging, performance evaluation) .. now that I find c# fast enough, I'm moving to all c#, but if some part needs to be in c++ that can be isolated (some math computation, graphing, pattern matching may fall into that area) .. yes multiple parallel processes are running. messaging between them .. no direct calls ..some producer / consumer architecture

(as an aside:: if you know about sound, I extensively used Fourier analysis and it is amazing similar

Fourier analysis is "the process of decomposing a musical instrument sound or any other periodic function into its constituent sine or cosine waves" .. one of my programs just did pattern matching to determine waveforms using a library graphs.. this was originally on mainframes) mostly useful for optimization.

Interesting post regarding you stock buys/sells.

Question ever

look to futures ? Leverage huge however its an index a bit more efficient

leverage is great tho. double edge sword need to calibrate properly

I

always remarked at a "reversal" at 03:00 or 03:30 est time with regards to

previous day close.

For example market selling off yesterday ( or even

intra day) then at 03:00 or 03:30 est program buying and very little pullback (

needs to be measured to some degree as its not straight up) index moves higher

to positive territory on the close or at least unch. This is not THAT frequent

but gut tells me if one could calibrate around the concept the risk reward would

be great, relative to draw down or stop etc

thoughts ?

Thank you

Yes, futures will be my next addition ... before that, I'll be working on

more robust pattern matching. Now my program can overlay a few known patterns

(trends , trends with pullback and breakout, reversals etc.) with the current

market data and decide which is the best match ..

I also see daily

patterns .. ....reoccur...

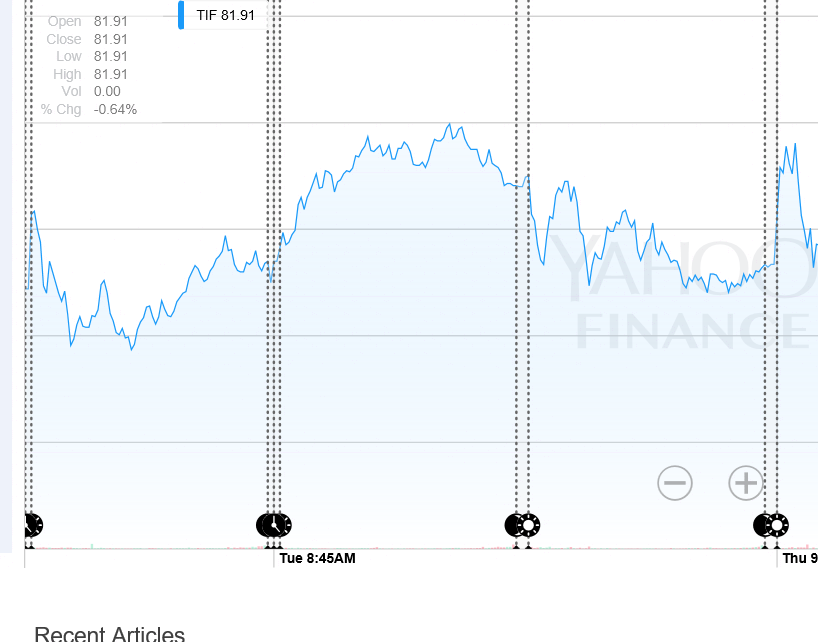

Here's one my

program found ... nearly everyday TIF has a rise and fall in the last 90 minutes

of the day ... computer trading apparently.. so I can (90% of the time) count on

a rise and fall around 3-4PM sometime earlier. This graph is Mon, Tue, Wed of

this week.

Thursday/Fri was some re-evaluations and ratings published ..

changed things... but if you look at the history is consistent..

TIF ...

so it would be good to create templates /outlines, then the program will overlay

it on the current data, (like your example), it could span days .. and then find

if it is generally matching the pattern, the program would make the intelligent

actions for matches...